UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

Filed by the Registrant | ||

| ||

Filed by a Party other than the Registrant | ||

| ||

Check the appropriate box: | ||

| Preliminary Proxy Statement | |

| Confidential, for Use of the Commission Only (as permitted by Rule | |

| Definitive Proxy Statement | |

| Definitive Additional Materials | |

| Soliciting Material under | |

| | |

First Midwest Bancorp, Inc. | ||

(Name of Registrant as Specified In Its Charter) | ||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

| ||

Payment of Filing Fee (Check the appropriate box): | ||

| No fee required. | |

| Fee computed on table below per Exchange Act Rules | |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

| Fee paid previously with preliminary materials. | |

| Check box if any part of the fee is offset as provided by Exchange Act Rule | |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

Certain Terms

| | |

Term | | Meaning |

401(k) Plan | | First Midwest Bancorp, Inc. Savings and Profit Sharing Plan, as amended |

Annual Meeting | | 2021 Annual Meeting of Stockholders of First Midwest Bancorp, Inc. |

Board of Directors or Board | | Board of Directors of First Midwest Bancorp, Inc. |

By-Laws | | Amended and Restated By-Laws of First Midwest Bancorp, Inc. |

Certificate of Incorporation | | Restated Certificate of Incorporation of First Midwest Bancorp, Inc., as amended |

common stock | | Common Stock, $0.01 par value per share, of First Midwest Bancorp, Inc. |

Company, First Midwest, we, us or our | | First Midwest Bancorp, Inc. |

CRATCE | | Core Return on Average Tangible Common Equity, which excludes certain items, such as securities gains and losses, acquisition and integration expenses and balance sheet and retail optimization costs |

Deferred Compensation Plan | | First Midwest Bancorp, Inc. Nonqualified Retirement Plan, as amended |

Exchange Act | | Securities Exchange Act of 1934, as amended |

FASB ASC 718 | | Financial Accounting Standards Board Accounting Standards Codification Topic 718 |

First Midwest Bank or Bank | | First Midwest Bank, which is a wholly-owned subsidiary of First Midwest Bancorp, Inc. |

Form 10-K | | First Midwest Bancorp, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2020 |

Gain Deferral Plan | | First Midwest Bancorp, Inc. Stock Option Gain Deferral Plan, as amended |

Internal Revenue Code | | Internal Revenue Code of 1986, as amended |

^KRX Index | | KBW Nasdaq Regional Banking Index (First Midwest Bancorp, Inc. is included in this index) |

M&A | | Mergers and acquisitions |

Named executive officers or NEOs | | Executive officers named in the Summary Compensation Table contained in this Proxy Statement |

Non-Employee Directors Stock Plan | | First Midwest Bancorp, Inc. Amended and Restated Non-Employee Directors Stock Plan, as amended |

Notice | | The Notice of Annual Meeting of Stockholders that accompanies this Proxy Statement |

Paycheck Protection Program or PPP | | The U.S. Small Business Administration’s Paycheck Protection Program |

Pension Plan | | First Midwest Bancorp, Inc. Consolidated Pension Plan, as amended |

preferred stock | | Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series A and Series C, of First Midwest Bancorp, Inc. |

Proxy Card | | The form of proxy card or voting instruction form that accompanies this proxy statement |

Proxy Statement | | This proxy statement |

Record Date | | March 26, 2021 |

SEC | | United States Securities and Exchange Commission |

Stock and Incentive Plan | | First Midwest Bancorp, Inc. 2018 Stock and Incentive Plan |

TSR | | Total Stockholder Return |

|

Welcome to the First Midwest Bancorp, Inc. |

Annual Meeting ofStockholders |

April 11, 201813, 2021

Dear Fellow Stockholders:

You are cordially invited to attend the 20182021 Annual Meeting of Stockholders of First Midwest Bancorp, Inc., which will be held on Wednesday, May 16, 201819, 2021 at 9:00 a.m., Central time, in a virtual meeting format only. As part of our continued precautions regarding the COVID-19 pandemic and in light of the priority we place on the health, safety and well-being of our stockholders and colleagues, the Annual Meeting will be held solely by means of remote communication. Stockholders will be able to listen, vote and submit questions from any remote location with Internet connectivity. Online check-in will begin, and stockholders may begin submitting written questions, at 8:45 a.m. Central time, and you should allow ample time for the Chicago Marriott O’Hare Hotel, 8535 West Higgins Road, Chicago, Illinois 60631.check-in procedures. For additional information on how to attend the Annual Meeting, please see Other Matters – Voting Your Shares.

The matters to be acted on at the Annual Meeting are described in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement. Also enclosed is a copy of our 20172020 Annual Report. Please review these materials carefully before voting.

We are pleased to offer multiple options for voting your shares. As detailed in the Proxy Summary section of the attached Proxy Statement, you may vote your shares via the Internet, by telephone or by mail. Voting in any of these ways will not prevent you from attending the virtual Annual Meeting. You may also may vote in person by written ballot atduring the virtual Annual Meeting.

Your vote is very important to us. Whether or not you plan to attend the meeting in person,virtual Annual Meeting, your shares should be represented and voted.

On behalf of our Board of Directors, I would like to express our appreciation for your continued interest in First Midwest. I hope you will be able to attend the virtual Annual Meeting.

| |

Sincerely, | |

| |

Michael L. Scudder | |

Chairman | |

First Midwest Bancorp, Inc.

|

Notice of Annual Meeting of Stockholders |

| |

Wednesday, May | First Midwest Bancorp, Inc.

Suite

|

| |

| |

| |

Virtual Meeting: The Annual Meeting will be held in a virtual meeting format only. | |

| |

As part of our continued precautions regarding the COVID-19 pandemic and in light of the priority we place on the health, safety and well-being of our stockholders and colleagues, the Annual Meeting will be held solely by means of remote communication. In order to attend the Annual Meeting via remote communication, you must access the virtual meeting at www.virtualshareholdermeeting.com/FMBI2021. You also will need a control number, which is the 16-digit number on your Proxy Card. Once admitted to the Annual Meeting, you will be able to vote your shares in accordance with the instructions provided on the meeting website. | |

| |

Items of Business: | |

| |

◆ To elect as directors the | |

◆ To approve the Amendment and Restatement of the First Midwest Bancorp, Inc. 2018 Stock and Incentive Plan. | |

◆ To approve an advisory (non-binding) resolution regarding the compensation paid in | |

| |

◆ To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, | |

◆ To transact such other business as may properly come before the Annual Meeting. | |

| |

Record Date: March | |

| |

You are entitled to vote at the Annual Meeting only if you owned shares of First Midwest Bancorp, Inc. common stock at the close of business on the | |

| |

Proxy Voting: | |

| |

It is important that your shares be represented and voted at the Annual Meeting. You can vote your shares via the Internet, by telephone or by mail. Voting in any of these ways will not prevent you from attending or voting your shares | |

| | | | | | | |

Internet | Telephone | Virtually | |||||

| |

| |

| |

| |

|

|

|

| ||||

Visit the website noted on your | | Use the toll-free telephone number noted on your | | Sign, date and return your | | Cast your vote | |

| | ||||||

By Order of the Board of Directors, | | ||||||

| | ||||||

Nicholas J. Chulos | | ||||||

Executive Vice President, General Counsel | April | ||||||

and Corporate Secretary | | ||||||

| | ||

1 | |||

| | ||

4 | |||

| | ||

CORPORATE SOCIAL RESPONSIBILITY AND DIVERSITY, EQUITY AND INCLUSION – OUR COMMITMENT | 8 | ||

| | ||

11 | |||

| | | |

20 | |||

| | ||

32 | |||

| | | |

| 33 | ||

| | ||

34 | |||

34 | |||

34 | |||

34 | |||

35 | |||

35 | |||

36 | |||

37 | |||

38 | |||

38 | |||

41 | |||

42 | |||

42 | |||

42 | |||

42 | |||

43 | |||

43 | |||

| | ||

INFORMATION REGARDING BENEFICIAL OWNERSHIP OF PRINCIPAL STOCKHOLDERS, DIRECTORS AND MANAGEMENT | 44 | ||

| | ||

46 | |||

| | ||

TABLE OF CONTENTS, CONT.

| | |

49 | ||

50 | ||

| 50 | |

| The COVID-19 Pandemic and its Impact on Our 2020 Incentive Compensation Program | 51 |

| 57 | |

| 57 | |

| 58 | |

59 | ||

| 60 | |

| 61 | |

| 62 | |

63 | ||

| 63 | |

| 63 | |

| 64 | |

65 | ||

| 65 | |

| 65 | |

| 65 | |

| Long-Term At-Risk Equity Compensation (Performance Shares and Restricted Stock) | 69 |

| 73 | |

| 74 | |

75 | ||

| 75 | |

| 75 | |

| 75 | |

| 76 | |

| Employment and Restrictive Covenant Agreements with Our Executive Officers | 76 |

| | |

77 | ||

| | |

78 | ||

78 | ||

80 | ||

81 | ||

83 | ||

83 | ||

84 | ||

84 | ||

85 | ||

86 | ||

91 | ||

| | |

92 | ||

| | |

93 | ||

| | |

| A-1 | |

PROXY STATEMENT

ThisWe are furnishing this Proxy Statement is being furnished in connection with a solicitation of proxies by the Board of Directors of First Midwest Bancorp, Inc., a Delaware corporation, to be usedfor use at our 20182021 Annual Meeting of Stockholders. The approximate date on which this Proxy Statement, the accompanying Proxy Card and our 20172020 Annual Report are first being sent or otherwise made available to stockholders is April 11, 2018.13, 2021. The following is a summary of the items to be voted upon at the Annual Meeting.

Date, Time and Place of the Annual Meeting of Stockholders

| | |

|

|

|

Matters to be Considered at the Annual Meeting

| | | ||

Items of Business |

| Voting | ||

| |

| ||

Election of Directors | | FOR | ||

|

| | ||

Approval of the Amendment and Restatement of the First Midwest Bancorp, Inc. 2018 Stock and Incentive Plan | | FOR | ||

| | | ||

Approval of an Advisory (Non-Binding) Resolution Regarding the Compensation Paid in | | FOR | ||

|

| | ||

|

| |||

Ratification of the Appointment of the Company’s Independent Registered Public Accounting Firm | | FOR | ||

| |

| 1 |

Proxy Summary

Election of Directors

The first item of business at the Annual Meeting will be the election of teneleven directors of the Company. The nominees including their key experience and our Board’s recommendation with respect to each, are set forth in the table below. Each nominee is currently a director of the Company. Our Board recommends that you vote FOR the election of each of the nominees below. See Item 1 Election of Directors.Directors.

| | | | | | |

| ||||||

| | | | | | |

Barbara A. Boigegrain | | Kathryn J. Hayley | | Ellen A. Rudnick | | Michael J. Small |

|

|

| ||||

| |

Former Executive Vice President of UnitedHealthcare | |

Senior Advisor and Adjunct Professor of Entrepreneurship at University of Chicago Booth School of Business | | Founder and CEO of K4 Mobility LLC Former President and CEO of Gogo, Inc. |

| | | | | | |

Thomas L. Brown | | Peter J. Henseler | | Mark G. Sander | | Stephen C. Van Arsdell |

| |

| |

| | Former Senior Partner, Chairman and CEO of Deloitte & Touche LLP |

| | | | | | |

Phupinder S. Gill | | Frank B. Modruson | | Michael L. Scudder | | |

| |

|

| |||

|

|

| ||||

|

|

| ||||

| |

|

| |||

|

|

| ||||

| |

|

| |||

|

|

| ||||

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

TableAmendment and Restatement of Contents

Proxy Summary

the First Midwest Bancorp, Inc. 2018 Stock and Incentive Plan

We are asking our stockholders to approve the Amendment and Restatement of the First Midwest Bancorp, Inc. 2018 Stock and Incentive Plan, including the issuance of additional shares of Common Stockcommon stock authorized thereunder. See Item 2 Approval of the Amendment and Restatement of the First Midwest Bancorp, Inc. 2018 Stock and Incentive Plan.

Advisory Vote on Executive Compensation

We are asking our stockholders to approve, on an advisory (non-binding) basis, a resolution regarding the compensation paid in 20172020 to our named executive officers as disclosed in this Proxy Statement. See Item 3 Approval of an Advisory (Non-Binding) Resolution Regarding the Compensation Paid in 20172020 to the Company’s Named Executive Officers.

Frequency of Advisory Vote on Executive Compensation

We are asking our stockholders to approve, on an advisory (non-binding) basis, that we present the advisory (non-binding) resolution regarding the compensation paid to our named executive officers annually. See Item 4 Approval of an Advisory (Non-Binding) Resolution Regarding the Frequency of Future Stockholder Advisory Votes on the Compensation Paid to the Company’s Named Executive Officers.

Ratification of Independent Registered Public Accounting Firm

We are asking our stockholders to ratify, on an advisory (non-binding) basis, the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2018. 2021. See Item 54 Ratification of the Appointment of the Company’s Independent Registered Public Accounting Firm.Firm.

| |

2 | First Midwest Bancorp, Inc. |

Proxy Summary

How to Vote

Even if you plan to attend our virtual Annual Meeting, in person, please cast your vote as soon as possible.

| | | | |

Internet | Telephone | |||

| |

| |

|

|

|

| ||

The web address for Internet voting can be found on | | The number for telephone voting can be found on | | Request a paper copy of the Proxy Card if you have not received one, and mark |

If you choose not to vote early, you can vote your shares in person atduring the Annual Meeting. You must present an acceptable formStockholders of identification (suchrecord as a valid driver’s license) to enterof the close of business on March 26, 2021, the Record Date for the Annual Meeting, may attend the meeting at www.virtualshareholdermeeting.com/FMBI2021by logging in and vote in person.

If you holdentering the control number found on the Proxy Card. Once admitted to the Annual Meeting, stockholders should follow the instructions on the website. You will need the control number included on your shares in street name, you may vote by following your broker’s instructions or,Proxy Card in order to vote in person at the Annual Meeting, you must obtain from the broker through which you hold your shares, both an account statement showing that you owned shares of Common Stock as of the Record Date and a “legal proxy” form, and bring them to the meeting.

If you attend the Annual Meeting as a representative of a stockholder that is an entity, then you must bring proof of your authorization to attend and act on behalf of that entity.

|

|

Proxy Summary

participate.

Important Notice Regarding the Availability of Proxy Materials

A copy of our Annual Report for the year ended December 31, 20172020 accompanies this Proxy Statement. The Notice, this Proxy Statement and our Annual Report are available at https://investor.firstmidwest.com/sec-filings/documents/www.proxyvote.com (if you utilize www.proxyvote.com, you will need the control number included on your Proxy Card). If you would like to receive, without charge, aan additional paper copy of our Annual Report, please contact our Corporate Secretary at First Midwest Bancorp, Inc., One Pierce Place, Suite 1500, Itasca, Illinois 60143 (prior to May 4, 2018) or at 8750 West Bryn Mawr Avenue, Suite 1300, Chicago, Illinois 60631 (on60631.

Certain Financial Information Presented on an Adjusted Basis

This Proxy Statement contains references to certain financial information on a core or after May 4, 2018)adjusted basis. This information excludes certain items, such as acquisition and integration related expenses, securities gains and losses, and balance sheet and retail optimization costs.

Certain Terms

Certain terms We believe that we usepresenting certain financial information in this manner assists stockholders in understanding our core financial performance and in assessing the Company’s underlying operational performance since these items do not pertain to our core business operations. Exclusion of these items facilitates better comparability between periods and enhances comparability for peer comparison purposes. For a reconciliation of the non-GAAP financial measures discussed in thisProxy Statement, have particular meanings,which include core net income and core return on average tangible common equity, in each case as set forth below.adjusted to exclude certain items, to the nearest comparable GAAP financial measures, see our Form 10-K filed with the SEC on March 1, 2021.

| |

2021 Proxy Statement | 3 |

First Midwest Today

First Midwest Bancorp, Inc. is a relationship-focused financial institution and one of the largest independent publicly traded bank holding companies based on assets headquartered in Chicago and the Midwest, with approximately $21 billion of assets and an additional $14 billion of assets under management. The Company’s principal subsidiary, First Midwest Bank, and other affiliates provide a full range of commercial, treasury management, equipment leasing, consumer, wealth management, trust and private banking products and services. The primary footprint for our branch network and other locations is in metropolitan Chicago, southeast Wisconsin, northwest Indiana, central and western Illinois, and eastern Iowa.

Our Response to the COVID-19 Pandemic and Maintaining Our Strength and Stability in 2020

Despite the challenging environment created by the COVID-19 pandemic, we remained focused throughout 2020 on executing on our business priorities of continuing to build an empowered, engaged and diverse team, growing and diversifying our revenues and investing in our future. We executed on our continued strategic expansion into Milwaukee by successfully completing our acquisition and integration of Park Bank in 2020, which added an additional $1.2 billion of assets, $1.0 billion of deposits and approximately $688 million of loans. We also increased our total assets in 2020 to nearly $21 billion (an increase of 17% over 2019), up from $18 billion in 2019, and grew our total deposits to $16 billion (an increase of 21% over 2019) and our total loans, excluding Paycheck Protection Program loans, to $14 billion (an increase of 9% over 2019), up from $13 billion for each of deposits and loans in 2019.

We maintained our top 10 deposit share in the greater metropolitan Chicago market (top 2 in south metro and top 3 in northwest Indiana) and gained a top 10 deposit market share in Milwaukee through our Park Bank acquisition. We increased our ratio of core deposits to total deposits to 87% in 2020, up from 77% in 2019, thereby maintaining our low-cost core deposit advantage. This diverse mix of deposits includes the benefits of PPP loan funds, as well other government stimulus programs and deposits assumed in our Park Bank acquisition.

In addition, despite the severe economic conditions in 2020, we had a record year of mortgage banking and wealth management income, proactively raised $230 million of additional capital and maintained a stable credit portfolio. Moreover, the challenges of 2020 did not deter us from continuing to take steps to advance our technology plan, increasing our technology spend by more than one-third from 2019, and enhancing our digital capabilities. The pandemic accelerated our already growing trend of increased online, mobile and digital offerings.

We achieved numerous successes in 2020 that fell outside of the ordinary course of business, as we shifted our energy and focus to the health, safety and well-being of our clients, colleagues and communities as they faced their own challenges brought on by the COVID-19 pandemic. We pivoted and adapted our platforms as well as our

| |

4 | First Midwest Bancorp, Inc. |

About First Midwest

distribution and operating models to respond to the needs of our colleagues and clients, and assisted with the stress on individual, business and local needs.

For our clients, we continued to keep much of our branch network open and operating during the height of the pandemic (with appropriate health and safety protocols) so that clients encountered no interruption in accessing financial services. We offered aid and support to help ease the financial burden for business and individual clients through payment deferral and fee assistance programs. In a matter of a few weeks, we also supported our clients and the economy generally by participating in the federally-sponsored Paycheck Protection Program. To do this, we quickly enhanced our infrastructure and mobilized a team of colleagues to accept, process and fund these loans.

For our colleagues, we established heightened health and safety protocols for those who were required to work at one of our branches or other locations in order to continue to serve our clients, implemented a remote working plan for over 1,000 colleagues, expanded our health benefits and support programs, provided special bonuses and pay premiums to essential front-line employees, made interest-free hardship and emergency relief loans to over 500 colleagues and enhanced benefits and paid time-off programs.

We strengthened our dedication to our communities as the First Midwest Charitable Foundation committed $2.5 million to support local organizations and COVID-19 relief efforts. We also took several steps to encourage philanthropic giving across First Midwest, including enhancing our matching gift program and encouraging contributions to nonprofit organizations that support civil rights, anti-racism and social justice causes.

Throughout 2020, we also furthered our long-standing commitment to diversity, equity and inclusion by continuing to build on our learning curriculum relating to inclusive leadership and cultural competency skills as well as offering opportunities for our colleagues to engage in open and honest conversations about race and equality to minimize unconscious bias. This commitment is embraced by all of our colleagues and is facilitated by our Head of Corporate Social Responsibility and Diversity, Equity and Inclusion and her team.

| |

2021 Proxy Statement | 5 |

About First Midwest

Our organizational accomplishments in 2020 are more fully described below. As noted above under Proxy Summary—Certain Financial Information Presented on an Adjusted Basis, we discuss our performance in this proxy statement both on a reported GAAP basis and on an adjusted basis. The adjusted information primarily excludes acquisition and integration expenses, securities gains and losses, and balance sheet and retail optimization costs, which allows us to properly assess our performance on a core basis and relative to peers.

| | | | | | |

Total Assets |

|

| Total Deposits | |||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

|

|

| Loans | ||||

| | | | | | |

$21 billion | | | ⇧ 21% | | | ⇧ 9% |

| | | | | | |

Increased total assets to $21 billion at December 31, 2020, up 17% from the end of 2019 and 34% from the end of 2018. | | | Grew total deposits to $16 billionat December 31, 2020, an increase of 21% from 2019. | | | Grew total loans to nearly $14 billion, excluding PPP loans, at December 31, 2020, an increase of 9% from December 31, 2019. Including PPP loans, total loans grew to $15 billion. |

| | | | | | |

| | | | | | |

Capital and | | | PPP Loan Assistance | | | Strategic Expansion |

| | | | | | |

| | $1.2 billion | | | Park Bank | |

| | | | | | |

Added 118 basis points of total capital by December 31, 2020, ending the year at 14.14% of risk-weighted assets, maintaining our financial strength and stability. Also doubled our allowance for loan losses as we implemented CECL in 2020 and prudently prepared for the possibility of increased credit losses given our limited visibility into the long-term effects of the pandemic at its outset. | | | Provided $1.2 billion of PPP loans, assisting over 6,700 clients and positively impacting nearly 150,000 small business employees and their families. | | | Closed our acquisition and completed the systems conversion of Park Bank in 2020, successfully expanding our footprint into the Milwaukee and southeast Wisconsin markets. |

| | | | | | |

| | | | | | |

Board | | | CSR and DE&I | | | Industry Leadership and Recognition |

| | | | | | |

Four of our continuing directors are diverse on the basis of gender or race, resulting in over 36% diversity on our Board. We were recognized by Women on Boards for having 25% female board membership. | | | In 2020, we continued our focus on corporate social responsibility, diversity, equity and inclusion, environmental impact and uncompromised integrity. We are planning to release our inaugural Corporate Social Responsibility and Diversity, Equity and Inclusion Reportin mid-2021, where we will discuss our progress in greater detail. | | | In 2020, we were again recognized as a Chicago Tribune Top Place to Work(we were the highest rated commercial bank in Chicago) and on the Forbes Best-in-State Bankslist. Two of our bankers were honored on Crain’s Chicago Notable Minorities List and one of our colleagues was named a “Corporate Woman of Achievement” by the National Association of Women Business Owners. |

| | | | | | |

| | | | | | |

Colleague Support | | | Client and Community Support | | | Dividends |

| | | | | | |

We enhanced our health and retirement benefits and provided greater flexibility and hardship time-off for our colleagues. We also expanded our interest-free emergency medical and hardship loansand enhanced our matching gift program. | | | We helped nearly 9,000 clientsthrough payment deferrals and other accommodations in response to the COVID-19 pandemic. We committed $2.5 millionfrom our First Midwest Charitable Foundation to support COVID-19 relief efforts. | | | We paid our 152ndconsecutive quarterly cash dividend on our common stock in 2020, resulting in cash dividends of $0.56per share in 2020, up from $0.54 total cash dividends in 2019. |

| | | | | | |

| |

6 | First Midwest Bancorp, Inc. |

About First Midwest

Our Vision, Mission and Values

|

|

|

VISION | MISSION | VALUES |

To be the partner of choice for financial services in the markets we serve, and one of the nation’s top performing financial institutions. | To help our clients achieve financial success. | To serve our clients with integrity, excellence, responsibility and passion. |

During 2020, we remained focused on our vision, mission and values, which drive our culture that is centered on client needs, rooted in service excellence, dedicated to bettering our communities and focused on attracting top industry talent. Our path to success is through our relationships with clients and our commitment to providing a superior client experience. These factors provide significant momentum for future earnings growth and enhance our position as a premier Midwest-based commercial bank committed to helping our clients achieve financial success. This commitment is at the core of all that we do.

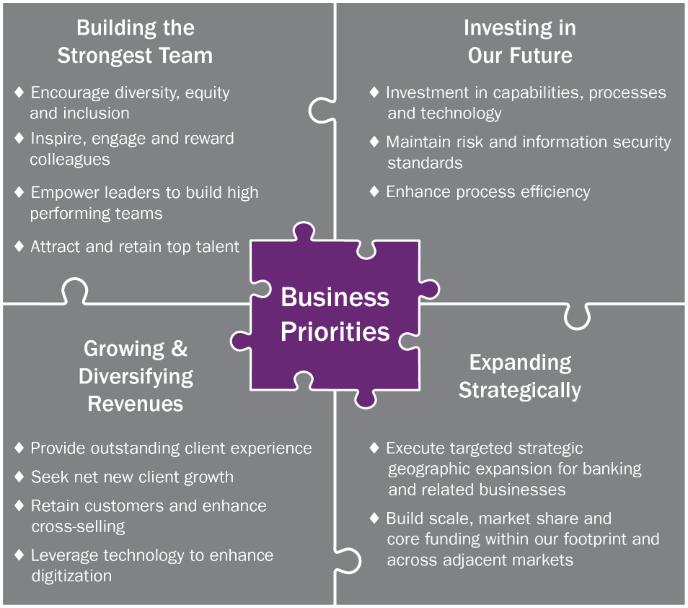

Business Priorities

In building our platform for continued profitable growth, we focus on the following priorities in order to position the Company for future success.

| |

2021 Proxy Statement | 7 |

CORPORATE SOCIAL RESPONSIBILITY AND DIVERSITY, EQUITY AND INCLUSION – OUR COMMITMENT

Our commitment to corporate social responsibility and diversity, equity and inclusion is ingrained in our corporate fabric. Throughout our history, First Midwest Bank has committed to treating all of our clients, regardless of stature or wealth, with respect and a focus on their financial needs. This commitment was inherited from our predecessors, runs 150 years deep and is currently overseen by our Head of Corporate Social Responsibility and Diversity, Equity and Inclusion and her team, with the full support of our Board of Directors, our Chief Executive Officer, our executive leadership team and our colleagues.

Anchored in our vision, mission and values, we drive business performance and accelerate economic and social momentum by investing in our colleagues, clients and the communities we serve. Diversity, equity and inclusion are at the core of our culture, which enables us to best meet the evolving needs of our colleagues, clients, communities, stockholders and other stakeholders. We are planning to release our inaugural Corporate Social Responsibility and Diversity, Equity and Inclusion Report in mid-2021. The framework for our approach to corporate social responsibility and diversity, equity and inclusion, which will be more fully discussed in our inaugural report, is outlined below.

| | | ||

| Talent Acquisition & Mobility Recruit, retain and develop diverse talent at all levels of the enterprise to drive high performing, productive and innovative teams | |

| Workplace Culture Foster a diverse culture of inclusion, belonging and trust where everyone feels valued and encouraged to express authenticity and uniqueness in the workplace |

| | | | |

| Community Investment & Visibility Accelerate inclusive economic momentum for individuals and businesses in the communities we serve through strategic philanthropy, partnerships, lending and investments | |

| Colleague Engagement Deepen colleague engagement and drive social impact through enterprise-wide volunteerism and giving platforms |

| | | | |

| Sustainability/Environmental Excellence Advance economic impact through socially responsible policies and sustainable environmental practices | |

| Corporate Governance Bolster confidence of our stockholders, regulators and clients through prudent and transparent governance, risk, ethical and compliance practices |

We are proud of our commitment to corporate social responsibility and diversity, equity and inclusion. Even with the pandemic-related challenges experienced in 2020, we have continued to develop and execute an integrated corporate social responsibility and diversity, equity and inclusion strategy that is aligned with our growth agenda as well as our ability to create long-term stockholder value. Our Board of Directors plays an integral role in overseeing our progress. Below is a brief description of some of our achievements in 2020.

| |

|---|---|

Talent Acquisition & Mobility | ◆ Our current colleague base is comprised of 69% women and 34% racial minorities. In 2020, of our overall jobs filled, approximately 62% were women and 46% were racial minorities. Of our hires into senior roles, 50% were either female or racial minorities. ◆ We attract top talent through our rotational development program for recent college graduates interested in careers in commercial banking and wealth management. In 2020, 50% of participants were diverse on the basis of gender or race. ◆ We created a 5-year strategic partnership with DePaul University to build diverse talent in early career programs through outreach, scholarship support and internship placements. ◆ Anchored in Chicago, our client base reflects a broad spectrum of diversity. We believe that we can best serve our clients and communities when our colleague base displays the same diversity of those whom we serve, and we are committed to replicating that diversity across our organization. |

| |

8 | First Midwest Bancorp, Inc. |

Corporate Social Responsibility

Workplace Culture | ◆ In 2020, our CEO, Michael L. Scudder, reinforced our commitment to diversity, equity and inclusion by signing the CEO Action for Diversity and Inclusion Pledge, one of the largest CEO-driven business commitments to act on and advance diversity, equity and inclusion in the workplace. ◆ Two of our bankers were honored on Crain’s Chicago Notable Minorities List and one of our colleagues was named a “Corporate Woman of Achievement” by the National Association of Women Business Owners. ◆ We have continued to build upon our leadership development and learning curriculum to inspire high performing teams through the implementation of inclusive leadership processes, unconscious bias mitigation techniques and the development of cultural competency skills. ◆ We maintain an ongoing diversity, equity and inclusion curriculum for our leaders, and our CEO held a series of listening sessions with our Black and Latinx colleagues. ◆ Civic leadership and skills-based volunteering through board service is highly encouraged and modeled at the top levels of the Company. Our CEO, members of our executive leadership team and many of our colleagues are active on civic and non-profit boards. |

Community Investment & Visibility | ◆ For almost 25 years, the Company has been rated Outstanding by the Federal Reserve under the Community Reinvestment Act, while growing in asset size and expanding our geographic footprint. ◆ We maintain branch locations that we believe are conducive and responsive to the needs of the communities we serve, including low- and moderate-income areas in our geographic footprint. ◆ In 2020, we extended approximately $264 million of community development loans, including loans related to our participation in the Paycheck Protection Program. ◆ We continued our long history of supporting our communities with a $2.5 million philanthropic commitment – our largest commitment to date – from our First Midwest Charitable Foundation to support organizations providing COVID-19 relief efforts and financial stability to individuals and families. ◆ We collaborated with various community groups to provide more than 80 financial education events – the majority of which were held virtually in 2020 due to the pandemic – that focused on saving, budgeting, homeownership and other topics that enhance the financial literacy of low- and moderate-income community members. We offer flexible banking products designed to build financial capabilities, including credit-building consumer products, down payment and closing cost assistance programs, affordable check cashing services, and no-fee checking accounts. |

Colleague | ◆ In 2020, we were again recognized as one of the Chicago Tribune Top Places to Work and we were the highest ranked commercial bank among large companies. We were also named one of Forbes’ Best-in-State Banks. ◆ In an effort to inform and communicate with our colleagues, our CEO held 15 virtual all-colleague town hall meetings throughout 2020.We maintained a dedicated pandemic portal with real-time updates and distributed 3 colleague engagement surveys. ◆ To support our colleagues during the pandemic, we provided bonuses and pay premiums to colleagues who continued to serve our clients from one of our locations, interest-free hardship and emergency medical loans for over 500 colleagues and we enhanced our benefits and paid time off programs. ◆ For many years, we have partnered with United Way in order to maximize our social impact. In 2020, we doubled our matching gift program to provide a 2:1 match for colleague contributions to non-profit organizations that support civil rights, anti-racism and social justice causes. Colleague participation in the program tripled from 2019. |

| |

2021 Proxy Statement | 9 |

Corporate Social Responsibility

Sustainability/ | ◆ We have initiated sustainability programs that impact our natural resource preservation, energy conservation and responsible waste management. Over the past 5 years, we have been aggressively replacing the existing lighting at our properties with more efficient and environmentally sustainable LED lighting, with 96% of our exterior lighting at our in-service properties and 50% of our interior lighting converted to LED. We have also implemented an enhanced shredding and recycling program at our branches and other locations. ◆ We have installed HVAC controls throughout our properties allowing us to better monitor, implement and control our energy saving techniques. ◆ In 2020, through our partners, we recycled approximately 465 tons of material, translating to nearly 8,000 saved trees, 3.2 million gallons in saved water, almost 28,000 pounds of pollutants kept from the atmosphere and 1.9 million kilowatts of energy saved. ◆ Over the last several years we have increased hoteling stations for colleagues with flexible work schedules, resulting in fewer vehicles on the roads and a reduction in carbon emissions. ◆ The COVID-19 pandemic accelerated our ongoing efforts to digitize our business, both for our clients, through the launch of our new website, enhanced online and mobile offerings and a push towards paperless transactions and statements, and for our colleagues, through new collaboration tools and a commitment to continuing to upgrade many manual processes to new digital and automated processes. ◆ We have begun to consider the effects of climate risk on our loan portfolio and other aspects of our business. |

Corporate Governance | ◆ We maintain a strong commitment to governance and ethics practices from our Board of Directors to our executive leadership and to all of our colleagues. ◆ Our colleagues adhere to a comprehensive Code of Ethics and Standards of Business Conduct that they are required to certify that they have reviewed each year. ◆ In addition to our regularly scheduled Board meetings, in response to the COVID-19 pandemic and in furtherance of maintaining business continuity, our Board met six additional times and received additional regular management updates throughout 2020. ◆ Stewardship of the Company’s corporate social responsibility resides with the Nominating and Corporate Governance Committee of our Board of Directors. The Committee receives regular updates on strategy, target metrics and results. ◆ We were recently recognized by Women on Boards for having 25% gender diversity on our Board of Directors. Currently, 36% of our Board is gender or racially diverse. ◆ We maintain strong enterprise risk management, including cyber risk management, processes. ◆ We maintain an active stockholder engagement program. For a fulsome discussion of our corporate governance practices, seeCorporate Governance at First Midwest. |

| |

10 | First Midwest Bancorp, Inc. |

Our Board of Directors currently consists of fifteen directors, but will be reduced to thirteen members as described below. Historically, the Board has been divided into three classes, with only one class standing for election at each annual meeting and each director serving for a three-year term. At our 2017 annual meeting, our stockholders approved an amendment to our Certificate of Incorporation to provide that directors will be elected to one-year terms on a go-forward basis, thereby declassifying the Board of Directors. The declassification of our Board is a three-year process that began last year and continues this year, with all nominees this year standing for election for a one-year term and a final class of three directors continuing in office until the end of their three-year term at our 2019 annual meeting of stockholders, at which meeting the declassification process will conclude and all nominees will stand for election for a one-year term.

Br. James Gaffney, Michael L. Scudder and J. Stephen Vanderwoude are members of the final class of directors whose terms expire at the 2019 annual meeting of stockholders and, as such, they are not standing for election at this annual meeting.

Nominees for Election

Our Board of Directors currently consists of twelve directors but will be reduced to eleven members as described below. Each director is elected for a one-year term. Upon the recommendation of our Nominating and Corporate Governance Committee, our Board of Directors unanimously nominated Barbara A. Boigegrain, Thomas L. Brown, Phupinder S. Gill, Kathryn J. Hayley, Peter J. Henseler, Frank B. Modruson, Ellen A. Rudnick, Mark G. Sander, Michael L. Scudder, Michael J. Small, and Stephen C. Van Arsdell to stand for election at this year’s Annual Meeting, all of whom are currently serving as directors of the Company.

Each of the nominees, other than Mr. Scudder, our Chairman and Chief Executive Officer, and Mr. Sander, our Senior Executive Vice President and Chief Operating Officer, meets the standards of independence under our Corporate Governance Guidelines and the rules of the NASDAQ Stock Market.

Robert P. O’Meara and Patrick J. McDonnellStephen Vanderwoude also currently serveserves as directorsa director and their terms expirehis term expires at this Annual Meeting. As previously announced, Mr. O’Meara,Vanderwoude, who has served as one of our directors since 1982, and Mr. McDonnell, who has served as one of our directors since 2002, each1991, has advised us that he will retire from the Board upon the conclusion of his current term. Mr. Vanderwoude has been a valuable member of our Board during his tenure as a director, and we have benefited greatly from his important contributions, strategic insight and other public company board experience. Mr. Vanderwoude also served as our first Lead Independent Director and helped establish the duties, responsibilities and expectations for this role.

Prior to the Annual Meeting, the Board will take action to reduce the number of directors to thirteeneleven members. As such, at and following the Annual Meeting, our Board of Directors will consist of thirteeneleven members until such time as the Board may determine to change the number of directors.

Directors of the Company are elected by a majority of the votes cast at the Annual Meeting. If a continuing director nominee fails to receive the required majority vote for election, the nominee willdirector is required to tender his or her resignation as a director in accordance with our By-Laws and Corporate Governance Guidelines, and the Board of Directors, upon the recommendation of the Nominating and Corporate Governance Committee, will determine whether it is in the best interests of the Company to accept or reject any tendered resignation, or whether other action should be taken. The Board of Directors will publicly disclose its decision and the rationale behind it within 90 days from the date of the certification of election results.results are certified.

Each nominee has informed us that he or she is willing to serve as a director if elected. Should any nominee become unable or refuse to serve as a director upon election, it is intended that the persons named as proxies on the Proxy Card will vote for the election of such other person as the Board of Directors may recommend.

Board Composition and Experience

Our thirteeneleven continuing directors have significant and diversevaried operational, financial, risk, technology, corporate governance, merger and acquisition, leadership and other experience. Overexperience, and possess diversity of skills, thought, gender and race. Our Nominating and Corporate Governance Committee monitors the past several years, fourcomposition of our directors have announced their retirementBoard of Directors and we have added fourperiodically seek to add new directors. Throughout this process, we have enhanceddirectors to the existingBoard where additional skills or experience are determined to be advisable and in an effort to enhance the industry and Company-specific knowledge of our Board of Directors with the fresh perspectives brought by our new directors. We believe the result is an even morethat our directors are active and engaged Board withand have the skill setsskills necessary to guide the Company as it grows, and as our business strategy and the banking industry around us continue to evolve.evolve and as the financial services sector becomes ever more competitive.

| |

|

|

Item 1 Election of Directors

The following charts illustrateBelow are certain demographic and operational highlights of our Board of Directors, including the varying tenure, diversity, and qualifications and experience of our continuing directors:directors.

| | | | | | |

8.8 years | | | 36% | | | 63 years |

| | | | | | |

Average Independent Director Tenure | | | Racial and Gender Diversity* | | | Average Age |

|

|

| | | | |

| | | | | | |

82% | | | Annual Elections | | | Engaged Board |

| | | | | | |

Independent | | | Directors elected each year for one-year terms | | | All directors attended 100% of 2020 meetings |

| | | | | | |

| | | | | | |

Director Education | | | 91% | | | Diverse Leadership |

| | | | | | |

Comprehensive director education provided throughout the year | | | Directors possess other public company experience | | | One of our female directors serves as our Lead Independent Director and two female directors chair Board Committees |

| | | | | | |

* | Three of our directors are diverse on the basis of gender and one of our directors is diverse on the basis of race. |

Each of our eleven continuing directors has extensive professional experience that contributes to a diversity of skills, perspectives and leadership qualities on our Board of Directors, as summarized below.

| |

12 | First Midwest Bancorp, Inc. |

Item 1 Election of Directors

|

|

|

| ||

Nomination Process

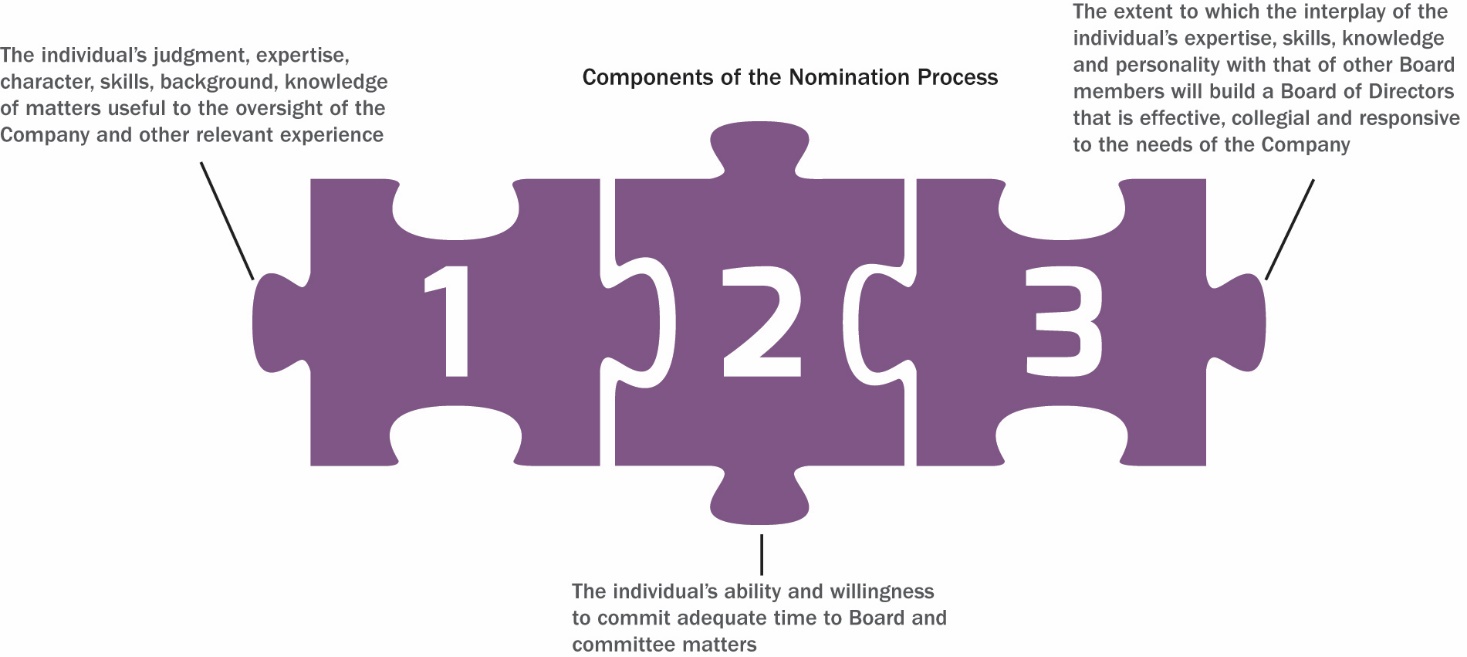

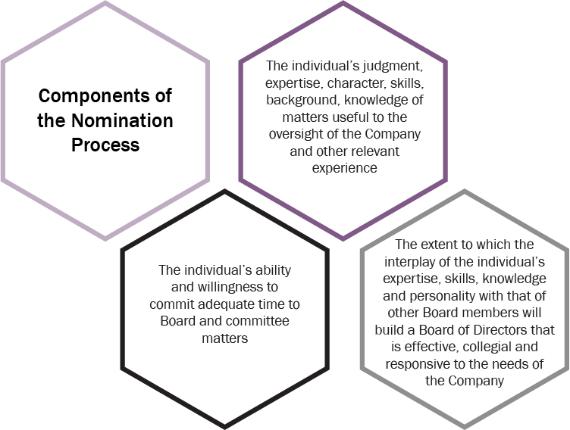

In identifying, evaluating and recommending nominees for the Board of Directors, our Nominating and Corporate Governance Committee places primary emphasis on the criteria set forth in our Corporate Governance Guidelines.

We do not set specific minimum qualifications that nominees must meet in order to be recommended to the Board of Directors. Each nominee is evaluated based on his or her individual merits, taking into account the needs of the Company and the composition of the Board of Directors.our Board. The Nominating and Corporate Governance Committee discusses and evaluates possible candidates in detail, and we sometimes engage outside consultants are sometimes engaged to help identify potential candidates.

|

|

Item 1 Election of Directors

When making recommendations for nominees to the Board, the Nominating and Corporate Governance Committee attempts to include directors who, when taken together with the other nominees and continuing directors, will create a group that offers a diversityrange of education, professional experience, background, age, gender or minority status, perspective, viewpointperspectives and skill.skills. The Nominating and Corporate Governance Committee will consider and evaluate director candidates recommended by stockholders in the same manner as other candidates identified by the Committee. A stockholder who desires to formally nominate a candidate must do so by following the procedures described in the Company’s Certificate of Incorporation and By-Laws.

| |

2021 Proxy Statement | 13 |

Item 1 Election of Directors

Set forth below is the name of each continuing member of the Board,director nominee, along with his or her age, principal occupation for at least the previous five years and other professional experience.

Nominees Standing for Election at the Annual Meeting

| | | | |

Barbara A. Boigegrain Current Position: Chief Executive Officer and General Secretary, Wespath Benefits and Investments Committee(s): Compensation Committee (Chair), Nominating and Corporate Governance Committee, Advisory Committee Independent Director Age: 63 Director Since: 2008 |

|

| Thomas L. Brown Current Position: Former Senior Vice President and Chief Financial Officer, RLI Corp. (NASDAQ) Committee(s): Audit Committee, Enterprise Risk Committee (Chair), Advisory Committee Independent Director Age: 64 Director Since: 2017 |

|

| | | | |

| ||||

Prior to 1994, Ms. Boigegrain spent eleven years as a consultant with Towers Perrin and four years with KPMG LLP and Dart Industries as a manager and analyst. Ms. Boigegrain As the CEO and General Secretary of Wespath, Ms. Boigegrain has overseen its restructuring, significantly improved its performance and services and increased its assets under management. In her experience as a benefits consultant, she established the San Diego office of Towers Perrin. |

Ms. Boigegrain earned a Bachelor of Arts degree in Biology and Psychology from Trinity University in 1979. REASONS FOR NOMINATION Through her extensive employee benefits, She also provides valuable knowledge of compensation, financial markets, strategic growth, and | |||

ESG and sustainability investing. | | |||

EXPERIENCE AND QUALIFICATIONS

|

|

Item 1 Election of Directors

| |||

| |||

Previously, Mr. Brown currently serves on the board of directors of |

Mr. Brown earned a Bachelor of Science degree in Accounting from Illinois Wesleyan University in 1979. He is a certified public accountant. REASONS FOR NOMINATION With his extensive finance, accounting, risk management and |

| |

14 | First Midwest Bancorp, Inc. |

Item 1 Election of Directors

| | | | |

Phupinder S. Gill Current Position: Former Chief Executive Officer, CME Group, Inc. (NYSE) Committee(s): Audit Committee, Enterprise Risk Committee Independent Director Age: 60 Director Since: 2010 |

|

| Kathryn J. Hayley Current Position: Chief Executive Officer, Rosewood Advisory Services, LLC Committee(s): Audit Committee, Compensation Committee Independent Director Age: 62 Director Since: 2016 |

| ||||

| | | | |

| ||||

Mr. Gill served as the Chief Executive Officer of CME Group Inc. Mr. Gill currently serves on the board of directors of The Alexander Maxwell Grant Foundation. From 2012 until his retirement on December 31, 2016, he served on the boards of CME Group and the World Federation of Exchanges. He also previously served on the boards of CME Clearing Europe (CME Group’s UK Clearing House), Bursa Malaysia Derivatives Berhad, Bolsa Mexicana de Valores, S.A.B. de C.V., CME Group Foundation and CME Group Community Foundation. Mr. Gill is a past member of CME Group’s Competitive Markets Advisory Council. |

Mr. Gill earned a Bachelor of Science degree in Finance in 1985 and a Master of Business Administration with a concentration in Finance in 1987 from Washington State University. REASONS FOR NOMINATION Through his board and executive management experience, Mr. Gill brings important public company, technology, He also provides the perspective of a former chief executive officer of a public company. | |||

| ||||

|

|

Item 1 Election of Directors

| |||

| |||

Ms. Hayley Previously, Ms. Hayley currently serves on the boards of directors of Concentrix Corporation (since December 2020; NASDAQ) and Alight Solutions, LLC (since 2018), as well as the advisory board of E.A. Renfroe & Company, Inc. (since 2016) |

Ms. Hayley earned a Bachelor of Science degree in Applied Computer Science from Illinois State University in 1979 and a Master of Business Administration, with concentrations in Marketing and Finance, from the Kellogg School of Management at Northwestern University in 1984. REASONS FOR NOMINATION Through her extensive information technology and financial services background and her broad executive management experience, as well as her |

| |

2021 Proxy Statement | 15 |

Item 1 Election of Directors

| | | | |

Peter J. Henseler Current Position: President, TOMY International Committee(s): Compensation Committee, Nominating and Corporate Governance Committee Independent Director Age: 62 Director Since: 2011 |

|

| Frank B. Modruson Current Position: President, Modruson & Associates, LLC Committee(s): Audit Committee, Enterprise Risk Committee Independent Director Age: 61 Director Since: 2016 |

| ||||

| | | | |

| ||||

Mr. Henseler is the President and a director of TOMY International, a wholly-owned subsidiary of TOMY Company, Ltd., a global designer and marketer of toys and infant products. Prior to joining RC2, Mr. Henseler held marketing positions at McDonald’s Corporation and Hasbro, Inc. In February 2018, he completed his tenure as Chairman of the Toy Industry Foundation and now serves as an executive advisor to the board. |

Mr. Henseler earned a Bachelor of Science degree in Marketing from Xavier University in 1980. REASONS FOR NOMINATION Mr. Henseler brings important executive management, operating and leadership skills and insights to our Board of Directors through his experience as a president of a global public company, as well as his substantial operational, brand management and marketing experience. | |||

| ||||

|

|

Item 1 Election of Directors

| |||

| |||

Mr. Modruson has served as President of Modruson & Associates, LLC, a management consulting firm, since 2015. Previously, Mr. Modruson spent the majority of his career at Accenture plc, a global professional services company, where he served as a client partner and as Chief Information Officer. He currently serves on the |

Mr. Modruson earned a Bachelor of Science degree in Computer Science from Dickinson College in 1984 and a Master of Science degree in Computer Science from Pennsylvania State University in 1987. REASONS FOR NOMINATION With his significant technology, strategy |

| |

16 | First Midwest Bancorp, Inc. |

Item 1 Election of Directors

| | | | |

Ellen A. Rudnick Current Position: Lead Independent Director of the Company; Senior Advisor and Adjunct Professor of Entrepreneurship, University of Chicago Booth School of Business Committee(s): Nominating and Corporate Governance Committee (Chair), Compensation Committee, Advisory Committee Independent Director Age: 70 Director Since: 2005 |

|

| Mark G. Sander Current Position: President and Chief Operating Officer of the Company Inside Director Age: 62 Director Since: 2014 |

| |||||

| | | | | |

| |||||

Prior to joining the University of Chicago, Ms. Rudnick served as President and Chief Executive Officer of Healthcare Knowledge Resources, President of HCIA, Chairman of Pacific Biometrics and Corporate Vice President of Baxter Healthcare Corporation. Ms. Rudnick currently serves on the boards of directors of She has spent over thirty years in |

Ms. Rudnick earned a Bachelor of Arts degree in Italian (with a minor in Economics) from Vassar College in 1972 and a Master of Business Administration with a concentration in Finance from the University of Chicago in 1973. REASONS FOR NOMINATION With her extensive business background and her public company board experience, Ms. Rudnick brings important leadership, corporate governance, business and entrepreneurial experience to our Board of | ||||

Directors. | | ||||

|

|

Item 1 Election of Directors

| |||

| |||

Mr. Sander is the Prior to joining the Company in 2011, Mr. Sander served as Executive Vice President, Director of Commercial Banking at Associated Banc-Corp (NYSE), where he oversaw Associated’s commercial banking, treasury management, insurance brokerage and capital markets businesses. He also served as a member of Associated’s Executive and ALCO Committees. Previously, he served as a commercial banking executive at Bank of America and in numerous leadership positions in commercial banking at LaSalle Bank. Mr. Sander has more than |

Mr. Sander earned a Bachelor of Science degree in Finance from the University of Illinois in 1980 and a Master of Business Administration with a concentration in Finance and International Economics from the University of Chicago in 1983. REASONS FOR NOMINATION Mr. Sander brings significant banking |

| |

2021 Proxy Statement | 17 |

Item 1 Election of Directors

| | | | |

Michael L. Scudder Current Position: Chairman and Chief Executive Officer of the Company Committee(s): Advisory Committee (Chair) Inside Director Age: 60 Director Since: 2008 |

|

| Michael J. Small Current Position: Chief Executive Officer, K4 Mobility LLC Committee(s): Compensation Committee, Enterprise Risk Committee Independent Director Age: 63 Director Since: 2010 |

| |||||

| | | | | |

Mr. Scudder is the Chairman of the Board (since 2017) and Chief Executive Officer (since 2008) of the Company. He also serves as Chairman and Chief Executive Officer of First Midwest Bank. Mr. Scudder served as the Company’s President from 2007 to 2019, and additionally as its Chief Operating Officer from 2007 to 2008 and as its Chief Financial Officer from 2002 to 2007. He has also served in various other leadership capacities across all areas of the Company in his thirty-five years of service to the Company and First Midwest Bank. Since becoming CEO in 2008, the Company has grown from $8 billion of total assets to $21 billion at the end of 2020. Mr. Scudder began his professional career at KPMG LLP, an international public accounting firm. Mr. Scudder is a member of the board of directors of the American Bankers Association and served as the chair of ABA’s CEO Council until August 2020. He is also an active member of the Mid-Size Bank Coalition of America. Mr. Scudder serves on the board of directors of Silver Cross Hospital, the board of trustees of DePaul University, the executive committee of DePaul University’s Center for Financial Services and the Chicago Metropolitan Planning Council’s Executive Advisory Board. Additionally, he is a member of the Economic Club of Chicago, the Commercial Club of Chicago and the Bankers Club of Chicago. He previously served as an inaugural member of the Federal Reserve Bank of Chicago’s Community Depository Institution Advisory Council. Mr. Scudder earned a Bachelor of Science degree in Accounting from Illinois Wesleyan University in 1982, and a Master of Business Administration with a concentration in Finance from DePaul University in 1993. REASONS FOR NOMINATION Mr. Scudder brings extensive executive management, financial and banking experience to our Board of Directors. He has important institutional knowledge of the Company and its business and clients, and his leadership has been critical to the growth and development of the Company. His day-to-day management of the Company provides the Board with Company-specific and industry experience and expertise, as well as a complete understanding of the Company’s vision, strategy and operations. | | EXPERIENCE AND QUALIFICATIONS | |||

Previously, Mr. Small served as the President and Chief Executive Officer and a director of Gogo, Inc. (NASDAQ), an airborne communications service provider, from 2010 until March 2018. Prior to joining Gogo, Mr. Small served as the Chief Executive Officer and a |

Mr. Small is Mr. Small earned a Bachelor of Arts degree in History from Colgate University in 1979 and a Master of Business Administration with a concentration in Finance from the University of Chicago in 1981. REASONS FOR NOMINATION Through his board, executive and financial experience, Mr. Small brings extensive public company, operating and | ||||

| | ||

18 | First Midwest Bancorp, Inc. |

|

|

Item 1 Election of Directors

| | | |||

Stephen C. Van Arsdell

Committee(s): Audit Committee (Chair), Nominating and Corporate Governance Committee, Advisory Committee Independent Director Age: 70 Director Since: 2017 |

|

| |||

| | | |||

| |||||

Mr. Van Arsdell is a former senior partner of Deloitte & Touche LLP, where he served as Chairman and Chief Executive Officer from 2010 to 2012, and as Deputy Chief Executive Officer from 2009 to 2010. Previously, he served as Deloitte’s partner-in-charge of its financial services practice in the Midwest, and Mr. Van Arsdell is a member of the Audit Committee of Brown Brothers Harriman & Co. (since 2015). He also is a member of the board of directors and a member of the Audit Committee of Mueller Water Products, Inc. (since 2019; NYSE). He is a member of the Dean’s advisory council for the Gies College of Business at the University of Illinois and |

Mr. Van Arsdell

REASONS FOR NOMINATION Mr. Van Arsdell brings to our Board extensive finance, accounting, | ||||

| |||||

* * *

|

|

Item 1 Election of Directors

Continuing Directors Serving a Term Expiring in 2019

| |||

| |||

|

| ||

|

|

Item 1 Election of Directors

| |||

| |||

|

| ||

| |||

| |||

|

| ||

|

|

Item 1 Election of Directors

For more information regarding our Board of Directors, its members, its committees and our corporate governance practices, please see the section of this Proxy Statement entitledCorporate Governance at First Midwestor visit the Investor Relations section of our website at www.firstmidwest.com/officersdirectorshttps://investor.firstmidwest.com/corporate-information/corporate-profile/.

|

Recommendation of our Board of Directors |

|

The Board of Directors unanimously recommends that stockholders vote FOR the election of each of |

| |

|

|

ITEM 2 APPROVAL OF THE AMENDMENT AND RESTATEMENT OF THE FIRST MIDWEST BANCORP, INC. 2018 STOCK AND INCENTIVE PLAN

Earlier this year, subject toWe are seeking stockholder approval our Compensation Committeeof the Amendment and our BoardRestatement of Directors approved the First Midwest Bancorp, Inc. 2018 Stock and Incentive Plan (the “New(for purposes of this Item 2, the “Amended and Restated Stock and Incentive Plan”). If, which is attached as Appendix A to this Proxy Statement. The Amended and Restated Stock and Incentive Plan will amend and restate our existing Stock and Incentive Plan, which was approved by our stockholders in 2018. Our Board of Directors, upon the Newrecommendation of the Compensation Committee, approved and adopted the Amended and Restated Stock and Incentive Plan, would succeedsubject to stockholder approval.

Stockholder approval of the existingAmended and Restated Stock and Incentive Plan is required to increase the number of shares of common stock reserved for issuance under the First Midwest Bancorp, Inc. Omnibus2018 Stock and Incentive Plan as amended (the “Predecessor Plan”). The Predecessor Plan was most recently approved by our stockholders at the 2013 annual meeting.

2,500,000 shares. As of March 23, 2018,26, 2021, the Record Date for the Annual Meeting, approximately 1,171,5481,070,036 shares of our Common Stockcommon stock remained eligible for issuance and 1,536,477 shares were subject to outstanding awards under the Predecessor Plan. Upon approval of the New Plan by our stockholders, we will cease making awards under the Predecessor Plan and only make awards under the New Plan. Any awards made under the Predecessor Plan that are outstanding at the time the New Plan is approved (i.e., unearned or unvested awards) will continue to be governed by the terms of the Predecessor Plan. The shares of our Common Stock remaining eligible for issuance under the PredecessorStock and Incentive Plan.

The Amended and Restated Stock and Incentive Plan (i.e., those not subject to outstanding awards), plus any of the shares subject to outstanding awards under the Predecessor Plan that are not issued or are cancelled by reason of the failure to earn the shares under the award, or the cancellation, forfeiture or expiration of the award, will be available for issuance pursuant to awards made under the New Plan.also includes certain clarifications and updates consistent with compensation best practices, as follows:

| ◆ | Clarifies that all Nonqualified Stock Options shall expire no later than ten years after the date of grant. |

| ◆ | Clarifies that, consistent with the Company’s existing practices, to the extent that dividends or dividend equivalents are credited to Performance Units or Performance Shares, such amounts shall not be paid until the performance period ends and the underlying Performance Units or Performance Shares have vested. |

| ◆ | Updates the treatment of Other Awards (as defined in the Amended and Restated Stock and Incentive Plan) in the event of a change in control to be consistent with the treatment of stock options, stock appreciation rights, restricted stock and restricted stock units and performance shares and performance units: Upon a change in control, in the event that a Substitute Award is not provided (which would provide for double trigger protection), all Other Awards will become fully vested and exercisable. |

The Company is asking stockholders to approve the terms listed above and authorize a number ofadditional shares of Common Stockcommon stock available under the NewAmended and Restated Stock and Incentive Plan at a level that the Company believes will, on the basis of current grant practices and plan design, be sufficient for awards for approximately five years following stockholder approval.through 2025. Approval of the NewAmended and Restated Stock and Incentive Plan will authorize 2,000,000an additional 2,500,000 shares of Common Stockcommon stock for award issuanceawards beyond the 1,171,5481,070,036 shares currently remaining eligible for issuance under the Predecessor Plan and being carried over to the New Plan and the 1,536,477 shares subject to outstanding awards under the Predecessor Plan,existing plan, for a total of 4,708,0253,570,036 shares authorized for or outstanding under equity awards to our employees.

The following description sets forth the material terms of the NewAmended and Restated Stock and Incentive Plan. It does not purport to be complete and is qualified in its entirety by reference to the provisions of the NewAmended and Restated Stock and Incentive Plan attached to this Proxy Statement as Appendix A. All capitalized terms that are not defined in this Proxy Statement are used as defined in the NewAmended and Restated Stock and Incentive Plan.

Purpose of the NewAmended and Restated Stock and Incentive Plan

The NewAmended and Restated Stock and Incentive Plan is intended to advance the interests of the Company and its subsidiaries by providing incentives and motivation to employees of the Company and its subsidiaries that will link their personal interests to the financial success of our Company and its subsidiaries. The NewAmended and Restated Stock and Incentive Plan is designed to provide flexibility to the Company and its subsidiaries in their ability to attract and retain the services of employees upon whose judgment, interest and effort the successful conduct of our operations is largely dependent.

Grant PracticePractices Uses Mix of Performance-Based and Time-Based Awards

We currently employutilize two types of long-term equity-based incentive compensation awards: restricted stock or restricted stock units (awarded to all participants), and performance shares (currently awarded to senior officers

| |

20 | First Midwest Bancorp, Inc. |

Item 2 First Midwest Bancorp, Inc. Amended and Restated Stock and Incentive Plan

only). Our Compensation Committee believes that using a mix of restricted stock and performance shares for our executive officers results in long-term incentive awards with the appropriate balance of strong retention value and a clear connection between results achieved and compensation earned. We have in the past also awarded stock options under the Predecessor Plan, although no stock options are currently outstanding. Awards to our Chief Executive Officer in recent years have been weighted more heavily to performance shares than restricted stock (approximately a 60/4065%/35% mix in 2017)2020), based on grant date value.

|

|

Item 2 Approval of the First Midwest Bancorp, Inc. 2018 Stock and Incentive Plan

Key Considerations

We are recommending that our stockholders approve the NewAmended and Restated Stock and Incentive Plan because we believe that the design of the New Amended and Restated Stock and Incentive Plan and the number of shares to be authorized for issuance thereunder will enable us to continue good corporate governance practices in granting equity to employees, consistent with the interests of stockholders.stockholders and reflective of current trends, competitive practices and investor attitudes. In addition, without approval of a newan amended and restated plan with additional shares, we will have sufficient shares to issue awards to our employees only through 2019.2022. The Compensation Committee was assisted by its independent compensation consultant infollowing highlights the analysis of current trends, competitive practicescertain key considerations regarding the Amended and investor attitudes relating to various aspects of the New Plan, such as the number of shares authorized for issuanceRestated Stock and usage of stock for long-term incentive awards, including the following:Incentive Plan:

BurnRun Rate

BurnRun rate, a measure of the speed at which companies use (or burn) shares available for grant in their equity compensation plans, is an important factor for investors concerned about stockholder dilution. The burnrun rate is defined as: the gross number of equity awards granted in a given year divided by the weighted average number of shares of common stock outstanding. Our burnrun rates for the past three years are shown in the chart below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year |

|

| Year |

| ||||||||||||||||||

|

| 2015 |

|

| 2016 |

|

| 2017 |

|

| Average |

|

| 2018 |

|

| 2019 |

|

| 2020 |

|

| Average |

|

Restricted Stock/Units |

| 452,756 |

|

| 493,744 |

|

| 480,854 |

|

| 475,785 |

|

| 427,000 |

|

| 497,000 |

|

| 655,000 |

|

| 526,333 |

|

Performance Shares |

| 112,249 |

|

| 123,519 |

|

| 142,756 |

|

| 126,175 |

| | 133,000 | | | 146,000 | | | 187,000 | | | 155,333 | |

Director Awards | | 14,000 | | | 14,000 | | | 20,000 | | | 16,000 | | ||||||||||||

Net Increase in Diluted Shares due to Equity Awards |

| 565,005 |

|

| 617,263 |

|

| 623,610 |

|

| 601,959 |

| | 574,000 | | | 657,000 | | | 862,000 | | | 697,666 | |

Weighted Average Basic Shares Outstanding |

| 77,071,659 |

|

| 79,810,079 |

|

| 101,443,121 |

|

| 86,108,286 |

| | 102,850,000 | | | 108,156,000 | | | 112,355,000 | | | 107,787,000 | |

Burn Rate |

| 0.73 | % |

| 0.77 | % |

| 0.61 | % |

| 0.70 | % | ||||||||||||

Adjusted Burn Rate (using ISS’s 3:1 conversion factor) |

| 2.20 | % |

| 2.32 | % |

| 1.84 | % |

| 2.10 | % | ||||||||||||

We use the annual usage of shares to help determine, among other things, the expected remaining life of a plan based on the remaining number of shares authorized for issuance under the plan. At similar annual usage levels, the 1,171,548 1,070,036 shares remaining eligible for issuance under the PredecessorStock and Incentive Plan may be depleted soon after the issuance of the Company’s annual equity awards in 2019.2022. The additional 2,000,0002,500,000 shares to be authorized upon approval of the NewAmended and Restated Stock and Incentive Plan, combined with the 1,171,5481,070,036 shares carried overavailable from the PredecessorStock and Incentive Plan, and shares that become available upon cancellations or forfeitures under the PredecessorStock and Incentive Plan, are currently expected to cover awards for approximately five years starting in May 2018.through 2025.

|

|

Item 2 Approval of the First Midwest Bancorp, Inc. 2018 Stock and Incentive Plan

Overhang

Overhang is a commonly used measure of assessing the dilutive impact of equity programs such as the NewAmended and Restated Stock and Incentive Plan. The overhang is equal to the number of equity award shares outstanding plus the number of shares available to be granted, divided by the total shares of common stock outstanding. Overhang shows how much existing stockholder ownership would be diluted if all outstanding awards and authorized but unissued shares were introduced into the market. As of March 23, 2018,26, 2021, the Record Date, the

| |

2021 Proxy Statement | 21 |

Item 2 First Midwest Bancorp, Inc. Amended and Restated Stock and Incentive Plan

additional 2,000,0002,500,000 shares being requested in this proposal would bring our aggregate overhang to 4.6%4.9%, as follows:

a | |||

|

|

|

|

Shares requested under |

| 2,500,000 |

|

Shares underlying outstanding awards under | 2,079,467 |

| |

|

|

| |

Shares available for issuance under | 1,070,036 |

| |

Total shares authorized for or outstanding under employee awards | 5,649,503 |

| |

Total shares outstanding | 114,334,259 |

| |

Overhang | 4.9 | % |

An overhang of 4.6%4.9% aligns with the median levels at commercial banking organizations, including the companies in our peer group.

Corporate Governance Aspects of the 2018Amended and Restated Stock and Incentive Plan

In designing and recommending the NewAmended and Restated Stock and Incentive Plan to our stockholders, the Compensation Committee and our Board of Directors also noted the strong corporate governance aspects of the NewAmended and Restated Stock and Incentive Plan, as summarized in the following table.

Significant Features |

| Description | ||

|---|---|---|---|---|

|

| |||

Limit on Shares Authorized |

| If the | ||

|

| The | ||

One-Year Minimum Vesting Period |

| Awards of shares under the |

| |

| First Midwest Bancorp, Inc. |

Item 2 Approval of the First Midwest Bancorp, Inc. 2018Amended and Restated Stock and Incentive Plan

Significant Features |

| Description | ||

|---|---|---|---|---|

|

| |||

No Discounted Stock Options or Stock Appreciation Rights |

| Stock options and SARs must have an exercise price equal to or greater than the fair market value of our | ||

No Re-pricing of Stock Options or Stock Appreciation Rights |

| Re-pricing of stock options and SARs is prohibited without stockholder approval, including by exchange for cash or a new or different award type. | ||

“Double-Trigger” Required for Vesting on Change-in-Control |

| A change-in-control of the Company does not, by itself, trigger full vesting of awards under the | ||

Clawback and Ability for Other Protective Provisions |

| The | ||

No Dividends or Dividend Equivalents Paid on Unvested Awards |

| No dividends or dividend equivalents on unvested awards will be paid until those awards are earned and | ||

Limits on Material Amendments and No Evergreen Provision |

| The | ||

Nontransferability of Awards | Awards granted under the Amended and Restated Stock and Incentive Plan may not be sold, transferred, pledged, assigned or otherwise alienated or hypothecated by a participant, otherwise than by will or by the laws of descent and distribution, until the underlying shares of common stock are earned and have vested. All rights granted to a participant with respect to an award under the plan are only exercisable by the participant and only during his or her lifetime. | |||

Independent Committee Administration | | The |

Awards and Shares Authorized Under Existing PlansPlan